In working with financial data, I often turn to various tools to simplify complex calculations. One of my go-to functions is the rate function in Excel’s Visual Basic for Applications (VBA). This handy feature helps me quickly ascertain the interest rate per period for loans or investments with consistent cash flow; it’s a core part of the financial category within VBA functions.

Using the VBA rate function, when I’m deep into coding, allows me to plug in the variables and get precise interest rates, automating what would otherwise be a time-consuming process. It’s especially useful in constructing financial models or worksheets, where understanding the cost of borrowing or the return on investment is pivotal.

Syntax

**RATE**(Nper, Pmt, Pv, \[Fv], \[Due], \[Guess])

- Nper: Total payment periods

- Pmt: Payment made each period

- Pv: Present value/principal

- [Fv]: Optional, future value

- [Due]: Optional, payment timing

- [Guess]: Optional, estimated rate

For the full documentation on the RATE function, I always check out the official Microsoft documentation. It’s super handy!

Arguments

When I’m tinkering with the RATE function in VBA, I need to wrap my head around a few key ingredients that make it all come together. Let’s break it down:

- Nper: I’m looking at how many times I’ll have to make a payment for the loan or investment. It’s the total number of payment periods.

- Pmt: This is all about consistency. It’s the payment amount I’ll commit to every period. No surprises here, it’s fixed.

- PV: That’s my starting point, the present value, or in simpler terms, the principal amount of my loan or investment.

- [FV]: Optional, but I like to define the future value of the investment or loan. If I skip this, VBA just figures it’s a zero.

As for timing:

- [Due]: Payments can be due at the beginning or end of a period. 0 for the end, 1 for the beginning. If I don’t specify, VBA assumes it’s at the end.

And for a bit of guesswork:

- [Guess]: This is my starting guess for what the interest rate might be. Not crucial, but it helps VBA get to the answer faster. No guess? No problem. VBA uses 10% as the default starting point.

Remember, these ingredients help cook up the monthly interest rate if I’m working with loans, or the rate of return for investments. Keeping these parameters in check ensures I’m not left scratching my head over any unexpected numbers.

Example

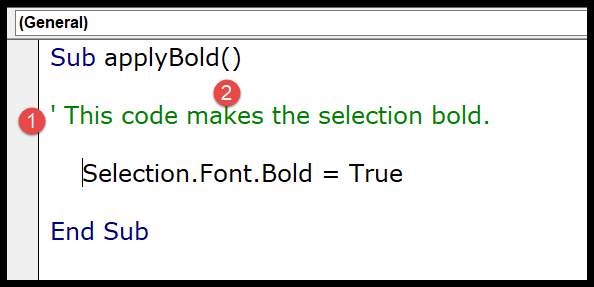

I just wrote some VBA code to figure out the interest rate using the WorksheetFunction.Rate method. Here’s a neat example that I think really showcases how to use it:

Sub example_RATE()

' Monthly payment is $1,200, future value is $98,000, over 60 months

Range("A8") = WorksheetFunction.Rate(60, -1200, 0, 98000, 1) * 12

End Sub

In my code, I set the future value of an investment at $98,000, the monthly payment at $1,200, over a term of 60 months. By multiplying the result by 12, I got the annual interest rate. Just pop this in, and it calculates that rate like a charm.

Notes

- When I calculate the interest rate of a loan in VBA using the

RATEfunction, here’s what I keep in mind:- Negative numbers represent cash going out—like my monthly payments.

- Positive numbers? That’s cash coming in—say, from an investment.

- It’s important to remember that the

RATEfunction is all about iteration. Think of it as making guesses until it gets close to the actual rate.- However, if VBA can’t nail down the rate within 20 iterations, it throws a

#NUM!error my way—a heads-up that it’s hit a calculation snag.

- However, if VBA can’t nail down the rate within 20 iterations, it throws a

- For any of my Excel automation, it’s crucial to ensure that spreadsheet cell references are accurate; otherwise, my cash flow calculations will be off.

- Savings and investments are all about managing my cash balance. Using the

RATEfunction, I can find the rate of return that’ll make my projected cash inflows and outflows meet over the life of an annuity.