When I’m crunching numbers in Excel, one feature I find indispensable for financial analysis is the VBA PV function. It’s a really useful tool coded in Visual Basic for Applications (VBA) that helps me understand the present value of an investment or a loan. It takes into account a fixed rate of interest and uniform payment amounts over time, making it easier to figure out the current worth of future cash flows.

Interestingly, this function mirrors the PV function found in Excel’s worksheet functions, but with VBA, I can automate tasks and run complex analyses with a bit more flexibility. It’s a win for anyone like me who prefers to evaluate the profitability of financial decisions with accurate, automated calculations in Excel.

Syntax

**PV**(*Rate*, *Nper*, *Pmt*, [*Fv*], [*Type*])

- **Rate**: My interest per period

- **Nper**: Total number of periods

- **Pmt**: Payment each period

- *Optional:*

- **Fv**: Future value or cash balance after last payment

- **Type**: When payments are due:

- 0 = end of period

- 1 = beginning of period

Arguments

Here’s a quick breakdown of the parameters I’ll need when I’m working with the PV function:

- Rate: My interest rate per period. Let’s say the annual percentage rate (APR) is 6%; for monthly calculations, I’ll consider the monthly interest rate instead.

- Nper: The total number of payments or periods. If I’m eyeing a 10-year loan with monthly payments, that’s 120 periods.

- Pmt: The amount of each payment. It’s the consistent figure I pay or receive each period.

- [FV]: Represents the future value or cash balance I want to have after the last payment. If I skip this, it’s assumed to be 0, meaning the loan is paid off.

- [Due]: This tells me when payments are due. ‘0’ means the payment is at the end of the period (like most loans), and ‘1’ is for the start.

Keeping these in mind helps me nail down the principal or present value of my loan or investment.

Example

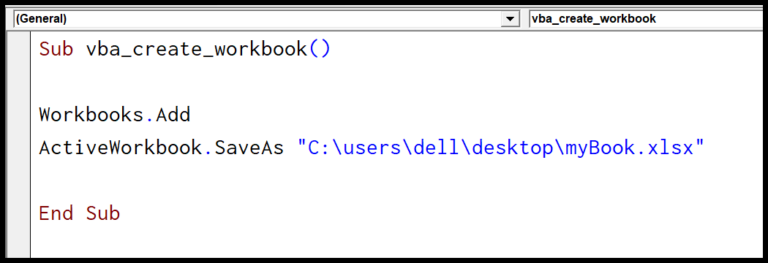

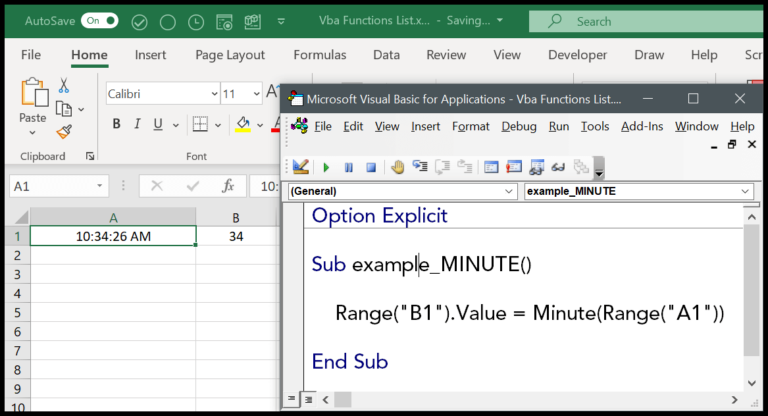

To calculate the present value in Excel using VBA, you can run a simple macro code like the one I’m about to share. Here’s what you do:

- Open your workbook and select the worksheet where you want the result.

- Save your workbook with a macro-enabled file extension, like

.xlsm. - Press

Alt + F11to open the VBA editor. - Insert a new module and collate the following lines of code:

Sub example_PV()

Range("A9").Value = PV(0.08 / 12, 5 * 12, -1500)

End Sub

- Close the editor and run this macro to execute the operation.

With this VBA code, I just told Excel to calculate the present value of an investment using an 8% annual interest rate, over a 5-year period, with monthly payments of $1500. It really simplifies the process, and the calculated savings result directly appears in cell A9.

Notes

- Interest Rate & Periods: I ensure that my ‘rate’ and ‘nper’ match up, measurement-wise. Mixed units could mess up my calculations.

- Cash Flow Signs: Remember, money out is a negative number, while money in is a positive number.

- Excel Versions: My formulas work across Excel 2003, 2007, 2010, and Excel 2011 for Mac.

- VBA: Using VBA for this takes a bit of learning, but the tutorials out there help a ton.

- Payments & Annuities: Whether it’s insurance or investment, tracking monthly payments requires keeping the timing consistent – start or end of the period matters.

- Type Argument: Defines when I make payments – 0 for end, 1 for beginning. It influences my result!