I often use VBA, or Visual Basic for Applications, when I’m dealing with repetitive tasks in Excel that need a bit of automation—saves me a lot of time and clicks. One of the handiest functions I’ve come across in the VBA toolkit is the PPMT function. It’s a financial function that’s particularly nifty when I want to figure out the principal part of a payment for a loan or an investment without mixing it up with the interest.

This function breaks down payments into what really goes towards the loan itself. Why is that cool? Because it gives me a clear picture of how each payment affects the core debt, letting me plan and track exactly where the money is going. This clarity is super useful when I’m managing my finances or when I’m creating financial plans in Excel for clients who like to see how their payments make a dent in the principal over time.

Syntax

PPmt(Rate, Per, Nper, Pv, [Fv], [Due])

- Rate: Interest rate per period.

- Per: Specific period for calculation.

- Nper: Total number of payment periods.

- Pv: Present value or total amount of loan.

- Fv: Optional. Future value after last payment.

- Due: Optional. Timing of payment (0 = end of period, 1 = beginning).

Arguments

When I work with the PPMT function, I’m handling a few key parameters:

- Rate: That’s the periodic interest rate I’m dealing with. If I’m looking at a loan with an annual interest rate, I’ve got to convert that to a monthly interest rate by dividing by 12.

- Per: This is basically which payment I’m honing in on. For instance, if I’m curious about the 10th payment, I’d set this as 10.

- Nper: The total number of payments I’m expecting to make for the loan or investment.

- PV: This stands for present value, or in simpler terms, it’s how much the loan is actually worth right now.

- FV: Future value is optional, and if I skip it, the function assumes it’s 0. It’s the amount anticipated when all the payments are completed.

- Type: Also optional. It dictates when payments are due; 0 means the end of the period, and 1 means the start. If I don’t mention it, 0 is the go-to.

So, I keep these in mind to calculate how much of my payment goes towards the principal at any point during the term. It’s pretty straightforward once I’ve got my numbers lined up.

Example

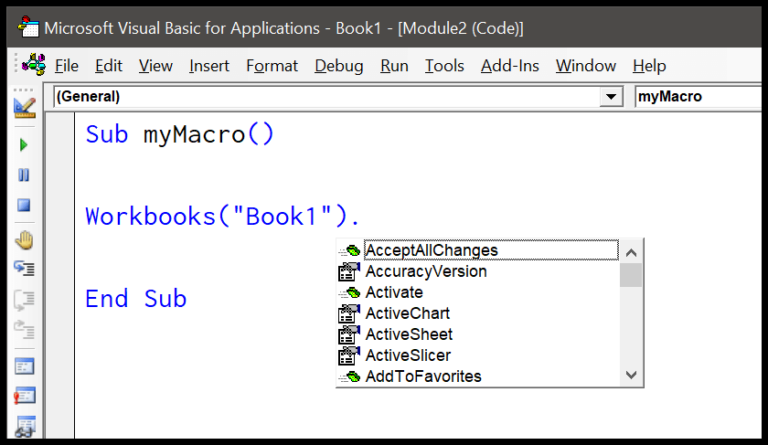

I often need to break down loan payments to manage my budget better. Let’s say I’m handling a $98,000 loan. Here’s how I use a simple VBA code in Excel to calculate the principal payment for the first month of a 5-year loan with an annual interest rate of 8%:

Sub example_PPMT()

' Monthly interest rate, period, total payment periods, principal amount

Range("A9").Value = PPmt(0.08 / 12, 1, 5 * 12, 98000)

End Sub

By inputting this formula, Excel crunches the numbers and gives me the monthly principal payment: $-1333.75. Understanding this helps me to plan my cash flow effectively, especially when dealing with fixed monthly payments.

Notes

- When I run a VBA PPMT function in Excel, a couple of things to keep in mind:

- Ensure

Peris within the range 1 to Nper, otherwise, I’ll get a run-time error 5. - The

PPMTfunction is ideal for calculating the principal part of a payment for any period during the lifespan of an annuity; this is essential to differentiate between principal and interest when dealing with loans or investments. - Remember that the function returns negative numbers for cash outflows (payments) and positive numbers for cash inflows (income).

- Ensure

- It’s compatible with a variety of Excel versions, including Excel 2016, 2013, 2010, 2007, Excel 2019, and Excel 2011 for Mac.

To avoid errors, I always double-check my values and the documentation if I’m uncertain. It’s a simple way to ensure everything runs smoothly when working with financial functions in Microsoft Excel. I can also find more examples and tutorials to reinforce my understanding and potentially save time on troubleshooting.