In Excel, playing around with numbers isn’t just about addition and subtraction; it’s about understanding the value of money over time too. The Excel NPV function is one such cool feature that helps evaluate the profitability of a venture. It’s all about net present value, or NPV for short, which represents the current worth of cash expected to come in the future. NPV takes into account a specific discount rate, kind of like reverse interest, to figure out how much future cash inflows are worth right now.

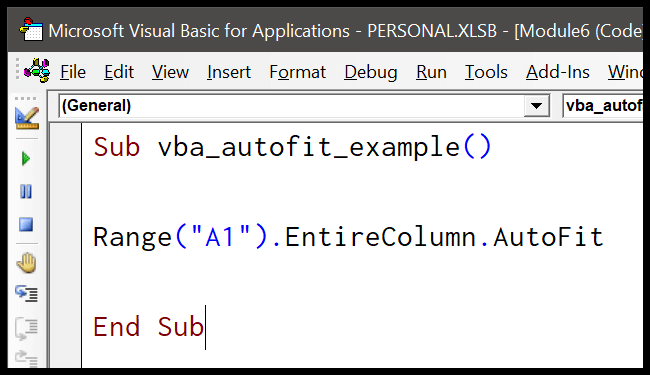

Jumping into Visual Basic for Applications (VBA), the NPV function takes the Excel game to a whole other level. When I write a bit of VBA code that includes the NPV function, I’m basically setting up a digital crystal ball that predicts the current value of expected cash flows from an investment. By entering a series of cash ins and outs, and an appropriate discount rate, I can swiftly calculate whether pouring money into a new project is brilliant or just wishful thinking. It’s like having a financial sixth sense, all thanks to a handy function in a spreadsheet.

Syntax

- My formula:

NPV(Rate, ValueArray)

Arguments

When I use NPV in my calculations, my goal is to assess the value of an investment considering both incoming payments and outgoing costs. I always take care to:

- Set

Rateaccurately, since it affects the resulting NPV. This is my discount rate, the rate at which future cash is valued in today’s dollars. - Prepare

ValueArray, ensuring it’s an array of cash flow values, mixing both expenses (as negatives) and income (as positives). - Remember that the first cash flow starts at the beginning of the first period.

- Input my cash flows in the precise order that payments and receipts occur.

By managing these variables carefully, I’m able to predict an investment’s profitability with more confidence.

Example

Let’s say I want to calculate the net present value (NPV) of an investment with some cash flows using VBA. I’ve already set up my cash flow data with the initial investment and expected payments over time. Here’s how I’d write the code:

Sub example_NPV()

Dim cF(0 To 9) As Double

Dim dRate As Double

' My initial investment is 1000 (outflow)

cF(0) = -1000

' These are my expected future cash flows (inflow)

cF(1) = 213.6

cF(2) = 259.22

cF(3) = 314.6

cF(4) = 381.79

cF(5) = 463.34

cF(6) = 562.31

cF(7) = 682.42

cF(8) = 828.19

cF(9) = 1005.09

' Let's assume my discount rate (interest rate) is already defined

Range("A1").Value = NPV(dRate, cF)

End Sub

I just assign a value to dRate representing my discount rate, and the NPV function does the calculation for me. The result? It gives me the present value of future cash flows considering my initial investment. This simple example teaches me exactly what the function is capable of!

Notes

- In my VBA macros, every array must have at least one positive and one negative value, or I’ll face a run-time error 5.

- I usually ensure that arrays reflect true business scenarios, like start-up costs (negative) and income (positive).

- When coding, I keep in mind that Excel functions can loop, which is handy for calculating values like internal rates of return.