In the world of Excel, the Visual Basic for Applications (VBA) toolkit is my go-to for automating tasks and crunching numbers like a pro, especially when it comes to handling financial data. Specifically, the IPMT function — a real powerhouse — lets me figure out the interest part of a loan payment with precision. It’s a fantastic feature for when I’m in the midst of planning out payments over time with a fixed interest rate, giving me the breakdown I need for each installment.

As someone who digs into Excel’s financial functions, I’ve found that VBA’s IPMT saves me a ton of time. It makes quick work of pinpointing the interest across various periods of a loan or investment, ensuring that every payment I make or analyze is transparent down to the cent. Whether I’m sorting out my own finances or setting up a payment plan for others, knowing exactly how much interest is being paid at every stage is invaluable, and it’s this detail that separates the savvy financial handlers from the novices.

Syntax

Here’s how I use the IPMT function in VBA:

- Rate: My annual interest rate divided by the number of periods.

- Per: The specific period I’m interested in.

- Nper: Total number of payment periods in the loan term.

- Pv: Present value or principal of the loan.

Optional Parameters:

- [Fv]: Future value or remaining balance after last payment.

- [Due]: When payments are due—beginning or end of a period.

Arguments

When I’m dealing with financial functions in VBA, such as the IPmt function, I keep track of a few key elements. Here’s a breakdown:

- Rate: The interest rate per payment period. It’s essential to get this right to calculate the interest correctly.

- Per: This is the specific period for which I’m interested in finding out the interest. It always falls between 1 and the total number of payments,

Nper. - Nper: Speaking of,

Nperis the total number of payment periods in the loan or investment. - PV: Short for present value, or in my terms, the initial amount of the loan or investment.

- [FV]: The future value or the cash balance I’m expecting after the last payment is made. It’s handy, but not always necessary, so it’s optional.

- [Due]: It tells me when payments are due – at the beginning (1) or end (0) of the period. If I don’t specify, it assumes the payment’s due at the end.

Now, it’s usually just the first four I need to keep track of: Rate, Per, Nper, and PV. The last two are named arguments that are optional, but can be really useful in certain calculations.

Example

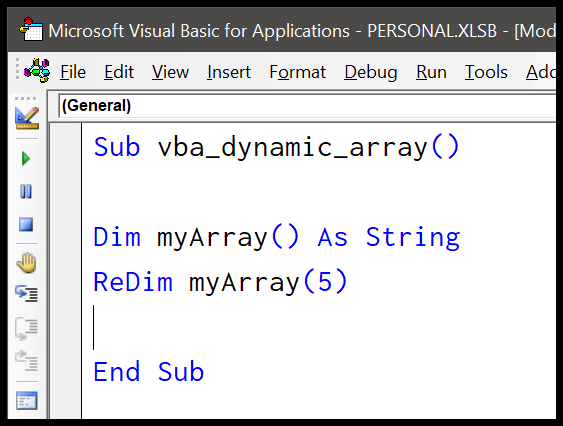

Here’s how I run a calculation for interest payments using the VBA IPMT function in Excel. I copy this code into a VBA module:

Sub example_IPMT()

Range("A10") = IPmt(0.08 / 12, 1, 5 * 12, 60000)

End Sub

What happens is I get the interest for the first month’s payment on a $60,000 loan with an annual rate of 8% over 5 years. When I run this, my cell A10 on the worksheet shows -$400.

If I change the per argument from 1 to 2 like this:

Sub example_IPMT()

Range("A10") = IPmt(0.08 / 12, 2, 5 * 12, 60000)

End Sub

My A10 cell now reflects the interest for the second month: -$394.56. WriteLine Example 2

Notes

- In Excel, when I handle investments using the IPMT function, cash outflows (like payments to a lender) appear as negative numbers.

- Conversely, cash inflows (like receiving payments) show up as positive numbers.

- It’s crucial to ensure the period for which I’m calculating the interest payment (Per) is within the total number of payment periods (NPer).

- If I get this wrong and Per is outside the valid range, I’ll trigger a runtime error 5.

- Cash paid out: `-` (negative numbers)

- Cash received: `+` (positive numbers)

- Correct Per range: `[1, NPer]`

- Incorrect Per: **error**

Remember, these details affect the cash balance on a worksheet when tracking loans or annuities.