In the dynamic world of software-as-a-service (SaaS), gauging a company’s trajectory requires monitoring more than just sales and revenue. The SaaS business model, with its reliance on subscription-based services and cloud computing, presents unique challenges and opportunities. This is where SaaS key performance indicators (KPIs) come into play. They provide a data-driven way to measure and guide a business’s direction, highlighting strengths to build on and weaknesses that need attention.

KPIs in the SaaS market serve as the navigational instruments for a company, steering it towards its long-term objectives. They encapsulate everything from customer engagement to financial health, giving stakeholders a comprehensive look at the company’s performance. For SaaS companies, which often prioritize recurring revenue and customer retention over one-time sales, KPIs are especially critical. They underscore how effectively a SaaS provider is attracting, satisfying, and maintaining its customer base.

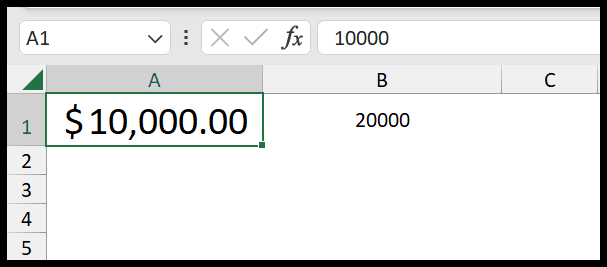

Analyzing these indicators is not just about putting numbers on a spreadsheet; it offers actionable insights that can be turned into growth strategies. Some of the essential KPIs that SaaS businesses keep an eye on include churn rate, customer lifetime value, and monthly recurring revenue. Each of these metrics sheds light on different aspects of the business, ensuring that the company not only survives the competitive software market but also thrives within it.

Understanding SaaS KPIs

To effectively track and steer a SaaS company towards its goals, one needs a firm grasp of the right Key Performance Indicators (KPIs). Let’s break down why these metrics are pivotal and how they align with the SaaS business model.

Importance of KPIs in SaaS

In the world of Software as a Service (SaaS), KPIs serve as navigational beacons. They let businesses know whether they’re on the right path towards their strategic objectives. By quantifying success, KPIs offer actionable insights for decision-makers.

- Growth Tracking: Pinpoint where growth is happening and at what rate.

- Customer Retention: Determine the effectiveness of customer satisfaction and retention strategies.

- Investor Reporting: Provide stakeholders with clear progress metrics.

Overview of SaaS Business Model

A SaaS business model is built around providing software via a subscription model. This setup demands a keen focus on long-term customer relationships and continual product improvement.

- Recurring Revenue: Central to sustainability and valuation.

- Customer Acquisition: A balancing act between cost and lifetime value.

Key Definitions

Metrics are the raw numbers that tell the story of day-to-day operations. These can include website traffic, server uptime, or feature usage.

KPIs, or Key Performance Indicators, are the distilled essence of metrics that matter most. They’re about quality, not just quantity. These indicators often include:

- Churn Rate: How many customers are leaving over a set time.

- Customer Lifetime Value (CLTV): Predicted revenue from a customer for the entirety of their relationship with the company.

- Monthly Recurring Revenue (MRR): The predictable income generated each month.

With these definitions in mind, businesses can more effectively align their metrics with strategies and goals, continually refining their operations and ensuring they adhere to their core business model.

Core SaaS Metrics

In the Software as a Service (SaaS) industry, tracking the right metrics can mean the difference between growth and stagnation. Here’s an insight into the core SaaS metrics that companies should monitor closely for a transparent view of their financial performance and customer satisfaction.

Monthly Recurring Revenue (MRR)

MRR is the heartbeat of any SaaS company, representing the predictable revenue generated each month. This metric is critical because it offers a glimpse into the company’s short-term financial health and stability. It’s calculated by summating the recurring revenue from all active customers within a month.

Annual Recurring Revenue (ARR)

ARR extrapolates MRR over the year, giving companies a long-term view of recurring revenue. It’s particularly helpful for SaaS businesses to assess year-over-year growth and for planning future business strategies. ARR is simply the MRR multiplied by 12.

Customer Lifetime Value (CLTV)

The CLTV is a forecast of the total revenue a company can expect from a single customer account throughout their business relationship. Calculated by multiplying the average monthly revenue per customer by their average lifespan, CLTV helps SaaS companies understand how valuable customers are over time.

Customer Acquisition Cost (CAC)

CAC measures how much it costs to acquire a new customer, taking into account all marketing and sales expenses. This metric is vital for determining the effectiveness and efficiency of marketing strategies and is calculated by dividing total acquisition expenses by the number of new customers gained.

Churn Rate

The churn rate is the percentage of customers who cancel or do not renew their subscription within a given time frame. A high churn rate can be a warning sign, prompting companies to examine customer satisfaction and their competitive edge. It’s found by dividing the number of churned customers by the total number of customers at the start of the period, usually tracked both as customer churn and revenue churn.

Growth and Sales Metrics

When analyzing the performance of a SaaS business, growth and sales metrics offer invaluable insights into the sales strategies and the company’s ability to attract new customers.

Customer Acquisition

In the realm of SaaS, customer acquisition is a critical compass pointing toward growth. A company’s capability to garner new customers hinges on a variety of factors, including the efficacy of marketing campaigns, the prowess of the sales team, and the inherent allure of the product or service offered. Key performance indicators (KPIs) in this area help companies to gauge these efforts and adjust strategies for maximum impact.

-

Leads Generated: This metric refers to the number of potential customers that show interest in the SaaS product. Businesses track this to assess the reach and effectiveness of marketing efforts.

-

Conversion Rate::

- Formula: Conversion Rate = (Number of Sales / Number of Leads) * 100%

- Example: If a company generates 1000 leads and 100 sales, the conversion rate would be (100 / 1000) * 100% = 10%.

Conversion rate underscores the success of turning prospects into paying customers and is a direct reflection of sales funnel efficiency.

-

Salesperson Performance: Each salesperson’s performance is often measured by the number of deals closed and the revenue generated. This gives insight into individual and team effectiveness.

The journey from lead to customer acquisition is a maze of marketing touchpoints and sales pitches. By measuring and analyzing these KPIs, companies can fine-tune their approach to not just attract but also convert prospects into loyal customers more efficiently.

Marketing Insights and Efficiency

In the world of SaaS, marketing efforts must be scrutinized for effectiveness and efficiency. They’re not just about driving interest but about crafting campaigns that resonate and convert.

Marketing Campaigns Performance

The performance of marketing campaigns is pivotal to assess both reach and impact. A solid indicator here is the conversion rate, which measures the percentage of leads who have taken a desired action, such as signing up for a free trial. Businesses also look at organic vs. paid traffic ROI to determine which channels are yielding better results and deserve more investment.

- Organic Traffic ROI: This measures the return on investment from non-paid sources such as search engine results and word of mouth.

- Paid Traffic ROI: This quantifies the return from paid channels, including pay-per-click advertising and social media ads.

By breaking down these metrics, a company can pinpoint the most lucrative marketing activities.

Lead Generation and Conversion

Effective lead generation is at the heart of a marketing strategy’s success. Product-qualified leads (PQLs), who have used a product and shown interest, are a step ahead of mere contacts. Monitoring signups is essential as they are a direct measure of lead generation efforts.

Once leads are generated, the focus shifts to conversion – transitioning a lead to a paying customer. Here, the conversion rate to customer is a telling metric. It reflects the efficiency of the marketing and sales funnel in converting interest to action.

- Signups: Tracking the number of users who sign up for a trial or free version, indicating initial interest.

- Conversion Rate to Customer: The percentage of leads who become paying customers, demonstrating the effectiveness of lead nurturing processes.

Retention and Loyalty Metrics

Understanding retention and loyalty metrics helps SaaS companies gauge their relationships with customers, which can direct strategies for maintaining and increasing their user base.

Net Promoter Score (NPS)

The Net Promoter Score (NPS) is a loyalty metric that quantifies the likelihood of customers recommending a company’s product or service. It is calculated by asking customers to rate their probability to recommend on a scale from 0 to 10 and categorizing them as detractors, passives, or promoters. A high NPS indicates strong customer loyalty and satisfaction.

Retention Rate

The Retention Rate is an essential metric for measuring a company’s success in retaining its customers over a period. A SaaS company might measure this on a monthly or yearly basis, typically by calculating the percentage of customers who remain subscribed to the service over that time. Consistently high retention rates often reflect the effectiveness of customer success initiatives and indicate a product’s value to its users.

Customer Retention

Customer Retention involves strategies and activities a company uses to prevent customer churn and increase the lifetime value (LTV) of its customers. The LTV is a prediction of the net profit attributed to the entire future relationship with a customer. Strong customer retention efforts suggest that a SaaS business places significant emphasis on customer success and loyalty programs.

Operational Performance

In SaaS, pinpointing the efficiency of operations involves a deep look at revenue per account, how well customer support is doing, and how users interact with the product.

Average Revenue Per Account (ARPA)

Measuring Average Revenue Per Account (ARPA) gives companies a clear picture of how much income they can expect per customer. It’s a critical figure that helps them assess whether sales strategies are hitting the mark and if customers are upgrading to more lucrative plans.

- To calculate ARPA: (Total Monthly Recurring Revenue) / (Number of Accounts).

- Efficiency Insight: A higher ARPA indicates a more efficient strategy in driving revenue per customer.

Customer Support Metrics

For customer support teams, swift and effective service is paramount. Two vital stats they keep tabs on are:

-

Average First Response Time: This is the average time it takes for a support team to first reply to a new support ticket. A quicker response time can lead to higher customer satisfaction.

- Efficient Support: Striving to reduce this time signifies a team’s efficiency in acknowledging customer issues.

-

Average Resolution Time: The average time it takes to fully resolve a support issue. This metric highlights a team’s aptitude in not just addressing, but also solving customer problems.

- In Practice: A lower average resolution time generally reflects a more agile and skilled customer support team.

Product Usage Analysis

When a company digs into product usage, it unearths valuable intel on customer engagement and which features get the most and least love. These insights are crucial for driving both product development and user experience enhancements.

- Key Metrics Include:

- Engagement rate: It gives a glimpse into how often and how long users are interacting with the product.

- Features Used: Identifying the most and least popular features can steer a company towards what needs refinement or promotion.

With these metrics on their radar, SaaS companies can home in on operational performance, ensuring they’re crafting an experience that reflects the needs and behaviors of their users while keeping their customer support as efficient as possible.

Advanced Analysis

In the realm of SaaS, advanced analysis means cutting through the data to uncover deeper insights that can drive strategic decisions. Diving into cohort analysis and segmentation by customer behavior, businesses can pinpoint trends, benchmark their performance, and gauge financial health with precision.

Cohort Analysis

Cohort analysis allows a company to break down its users into groups based on shared characteristics or behaviors over specific time periods. This approach is pivotal for understanding the life cycle of a customer base. For instance, a SaaS business might track a cohort’s monthly revenue growth, revealing how product updates impact customer spending. They can track these cohorts:

- By sign-up date to measure retention and churn rates

- By feature usage to assess the most and least engaging aspects of the application

Imagine a table that isolates each cohort’s:

- Monthly Revenue: To note spending patterns or spikes in response to feature releases or marketing campaigns.

- Viral Coefficient: To understand how word-of-mouth contributes to user growth within each cohort over time.

Segmentation by Customer Behavior

Segmentation by customer behavior slices the user base into groups based on how they interact with the service. This segmentation sheds light on which features or user paths correlate with higher revenue or engagement. A SaaS company might track:

- Unique Visitors: Those who repeatedly engage with the service each month.

- CRM Activity: How interactions with customer support or sales influence user behavior and satisfaction.

They can also measure the Revenue Churn Rate to see which behaviors hint at a higher likelihood of subscription cancellations. This segmentation helps in identifying behaviors to target or avoid in future development and marketing efforts, ensuring they’re always responding to the Internet’s evolving dynamics. By leveraging these advanced analytical techniques, SaaS businesses can optimize their strategies for maximum impact.

Tools and Software for Tracking KPIs

Tracking SaaS metrics efficiently requires robust tools and software, especially when teams aim to convert insights into actionable targets. Dashboards play a crucial role here by consolidating data in a user-friendly format.

For marketing teams, tools like Google Analytics offer deep dives into website traffic and user behavior. They can track the journey of potential customers from visitors to paying customers. This data informs which channels are most effective, helping to fine-tune marketing strategies.

Product managers often use specialized SaaS dashboards. They focus on software engagement metrics, like feature usage, to understand the product’s impact on customer retention. Here’s how different roles might utilize such tools:

-

Product Managers:

- Feature Adoption Rate: Assesses the usage of new features.

- Engagement Score: Gauges how interactively users engage with the software.

-

Marketing Teams:

- Customer Acquisition Cost (CAC): Tracks the investment required to obtain a new customer.

- Conversion Rates: Measures the effectiveness of marketing campaigns.

Creating actionable targets starts with setting clear goals within these tools. By using real-time data, teams can adjust strategies promptly and effectively.

Below is a suggested format for a dashboard:

| Metric | Description | Target | Current |

|---|---|---|---|

| Churn Rate | % of customers who cancel | ≤ 5% | 7% |

| Monthly Recurring Revenue (MRR) | Incoming revenue from subscriptions | Increase by 10% | 5% |

| Customer Lifetime Value (CLV) | Average revenue per customer | Improve by 15% | Stagnant |

In a nutshell, SaaS companies thrive on insights drawn from these tools, influencing decisions from product development to marketing.

Making Data-Driven Decisions

In the dynamic SaaS market, startups and established companies alike lean heavily on data-driven strategies to meet their goals. They carefully track high-level metrics and Key Performance Indicators (KPIs)—the compass that guides their journey toward progress and success.

Actionable insights come from analyzing these KPIs, which then inform the business’s next steps. For instance, a startup might observe its Quick Ratio to understand how effectively it’s growing revenue relative to churn. This metric is a snapshot of financial health, allowing leaders to gauge whether their strategy needs a pivot.

Companies often prioritize a Customer Engagement Score, as it’s a direct indicator of product value and satisfaction. High engagement often correlates with lower churn, making it a KPI that can forecast long-term success. Here’s a list of some critical SaaS metrics that companies keep an eye on:

- Bookings: Total value of contracts signed within a period.

- Monthly Recurring Revenue (MRR): The predictable revenue stream each month.

- Customer Lifetime Value (CLTV): Predicted revenue from a customer over the duration of their relationship with the company.

- Churn Rate: The rate at which customers cancel their subscriptions.

These KPIs present more than just numbers. They translate user behavior and financial operations into insights that companies can act upon. By interpreting this data, SaaS businesses make informed decisions—whether it’s addressing a sudden spike in churn or doubling down on a surge in bookings—to steer clear towards their defined strategic goals.

Case Studies and Real-world Examples

When diving into the successes of SaaS companies, nothing speaks louder than detailed case studies and real-world examples. They illuminate the practical application of SaaS KPIs within the B2B realm, showcasing how startups to established players pivot their business strategies by monitoring the right metrics.

For instance, consider a SaaS startup that meticulously tracks its Monthly Recurring Revenue (MRR) and Customer Acquisition Cost (CAC). By observing the trend lines of these KPIs, the company adjusts its pricing plans and optimizes its sales funnel, resulting in sustainable growth. The case study of this startup would highlight the direct correlation between data-driven decisions and business outcomes.

Another example could be an established SaaS provider focusing on Customer Lifetime Value (CLTV) to tweak its business model for long-term profitability. Through compelling narratives, case studies explain how strategic KPI tracking and adjustments to services lead them to retain a loyal customer base and expand their market share.

The table below summarizes typical KPIs monitored in SaaS case studies:

| KPI | Purpose in Case Study |

|---|---|

| MRR | Demonstrates growth and revenue stability |

| CAC | Shows effectiveness of marketing spend |

| CLTV | Illustrates long-term value generated from customers |

| Churn Rate | Indicates customer retention and product-market fit |

| Conversion Rate | Measures efficiency in turning leads into customers |

Case studies pull back the curtain on how these metrics weave into the narrative of a SaaS company, while real-world examples reinforce the viability of these metrics in everyday business decisions.

Optimizing KPIs for Long-term Success

For SaaS companies, long-term success hinges on the optimization of key performance indicators (KPIs). They should focus particularly on their customer retention rate, as it reveals the percentage of users who remain engaged with the service over a specific period. A robust retention rate is often indicative of sustained revenue growth and customer satisfaction.

They should also give considerable attention to the customer conversion rate. This metric measures the efficiency at which prospective users become paying customers, which is vital for any business, especially in the B2B sector where the sales cycle can be lengthy and complex.

To optimize these KPIs, SaaS companies may employ strategies such as:

- Personalized marketing campaigns to boost conversion rates.

- Customer service improvements that help in retaining users.

- Frequent product updates that respond to users’ needs.

By leveraging data to fine-tune these strategies, they can better allocate resources and improve ROI. Here’s a quick look at some actionable steps:

| Action Item | Objective |

|---|---|

| Analyze User Feedback | Improve product features and usability. |

| Enhance Support Services | Increase user satisfaction and retention. |

| Refine Sales Processes | Streamline the path to conversion. |

In essence, by routinely monitoring, analyzing, and refining the strategies based on these KPIs, SaaS companies enhance their potential for long-term success. The focus should always be on creating value for the user, which, in turn, drives sustained business growth.

Conclusion

Monitoring the right SaaS KPIs empowers companies to make informed decisions and pivot towards more prosperous strategies. It’s the difference between flying blind and navigating with a clear map. The future may be uncertain, but with solid metrics, companies can predict trends and customer behaviors, setting themselves up for success.

Key metrics such as Customer Retention Rate (CRR) and Monthly Recurring Revenue (MRR) aren’t just numbers; they reveal the story of a product’s value and its market fit. Churn Rates, both in revenue and customer turnover, highlight areas needing immediate attention, providing opportunities for rapid improvement.

A SaaS dashboard serves as the control center, offering a real-time snapshot of health and progress. It’s crucial for SaaS companies to continue refining their approach to KPI tracking, staying agile as the landscape evolves. As they pivot and adapt, the data gleaned from KPIs will steer their efforts toward stronger customer relationships and sustained growth.

Key Takeaways:

- Stay agile in response to KPI trends.

- Track both customer and revenue churn to pinpoint improvement opportunities.

- Use a SaaS KPI dashboard for real-time insights.

These strategies ensure that SaaS providers can maintain a competitive edge, keep customers satisfied, and grow their business with confidence well into the future.

Frequently Asked Questions

In this section, they’ll touch on common curiosities about SaaS KPIs, including which metrics matter most and resources for deeper understanding.

Can you give me some examples of key KPIs for SaaS companies?

Key KPIs for SaaS companies include Customer Churn Rate, which indicates customer retention and turnover, and Monthly Recurring Revenue (MRR), essential for tracking revenue stability.

What are the most important KPIs for B2B SaaS businesses?

For B2B SaaS businesses, the Customer Lifetime Value (CLV) and Customer Acquisition Cost (CAC) are vital as they reflect the long-term value and cost-effectiveness of client relationships.

How can I effectively structure a SaaS KPI template?

An effective SaaS KPI template should be structured to include essential metrics like Annual Recurring Revenue (ARR) and Profitability KPIs, segregated by financial, marketing, and operational categories for clarity.

What’s the nitty-gritty behind KPI meanings in a SaaS context?

In a SaaS context, KPIs like Activation Rate and Lead Conversion Rate are the nuts and bolts, giving you insight into how users engage with the product and the efficiency of the sales funnel.

Where can I find a guide to understand SaaS KPIs?

Guides to understand SaaS KPIs can be found in comprehensive resources from user-centered platforms like UserGuiding or specialized SaaS analytics tools that often offer in-depth articles and templates.

What are some financial KPIs critical to SaaS models?

Critical financial KPIs for SaaS models include Cash Flow, which tracks the movement of money in and out, and Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA), reflecting operational profitability.