Selecting the right accounting software for a Salesforce business is not just about finding a capable system; it’s about integration and cohesion between customer relationship management and finances. For small to medium-sized businesses anchored in Salesforce, solutions like QuickBooks Online have become popular because they offer a seamless connection, ensuring that financial and customer data synchronize effectively. These integrations prevent the need for separate platforms and provide a unified view of company operations, which is a key advantage for businesses looking to streamline processes.

However, for businesses deeply entrenched in the Salesforce ecosystem, native accounting software like Accounting Seed takes the compatibility to the next level. Built on the Salesforce platform, these native solutions offer a more fluid experience, eliminating the complexity that might come with integration. They are designed specifically to work within the Salesforce interface, ensuring that the workflow is uninterrupted and data moves smoothly between systems.

With these considerations, businesses must weigh the ease of use, sustainability, and the specific needs of their operations when choosing the best Salesforce accounting software. Whether it’s going for a well-recognized product like QuickBooks Online that promises robust integration, or opting for a native solution that resides entirely within the Salesforce platform, making the right choice depends on the unique demands of the business functions and the level of integration desired.

Understanding Sales Force Accounting Software

Accounting software within the Sales Force ecosystem plays a crucial role in streamlining financial tasks right where customer interactions are managed.

Defining Accounting in the Sales Force Context

In the realm of Sales Force, accounting software is a specialized tool designed to manage an organization’s financial transactions and records directly on the platform. This software typically encompasses features like invoices, expense tracking, and revenue recognition. It’s built as a native application on the Salesforce platform, ensuring a tight integration with the CRM’s extensive database capabilities.

Role of CRM in Accounting Software

Customer Relationship Management (CRM) systems, like Sales Force, aren’t just about tracking customer interactions. They often serve as a critical backbone, connecting various business processes. When CRM houses accounting software, it streamlines data flows and can even deploy AI to predict trends and automate tasks. This saves time and can significantly reduce errors, ensuring that financial data reflects the most up-to-date interactions with customers.

Core Features of Effective Sales Force Accounting Tools

Choosing the right sales force accounting software means looking for tools that streamline and enhance financial operations. Key features should not only cover the basics of accounting but also offer integrated, automated solutions tailored for sales-focused environments.

Automated Financial Management

Effective sales force accounting software features automation in billing and invoicing, reducing the need for manual data entry and minimizing errors. Users can expect a more efficient workflow, allowing them to focus on sales and customer relationships.

General Ledger and Reporting

A robust general ledger is at the heart of reliable accounting tools, ensuring all financial data is centralized and accurate. Comprehensive financial reporting capabilities allow for real-time insights into the financial health of the business, making critical decision-making faster and more informed.

Accounts Receivable and Payable Tracking

Keeping tabs on AR (accounts receivable) and AP (accounts payable) is vital. These tools simplify tracking outstanding invoices and managing expenses. Users can easily monitor cash flow and stay abreast of their financial commitments with detailed ledger entries and reporting functionalities.

Customizable Dashboards and Analytics

Sales force accounting software often includes customizable dashboards and analytics, providing at-a-glance views that are scalable to the needs of the business. Innovative dashboards offer comprehensive analysis of sales, financial trends, and projections which help in strategizing and achieving sales targets.

By focusing on these core features, sales force accounting tools empower businesses to maintain meticulous records, automate and optimize financial processes, and derive actionable insights from their financial data.

Integration and Synchronization Capabilities

In the realm of Salesforce accounting software, the ability to integrate seamlessly and guarantee consistent data synchronization is crucial. This ensures that financial data flows smoothly across various business systems.

Seamless Salesforce Integration

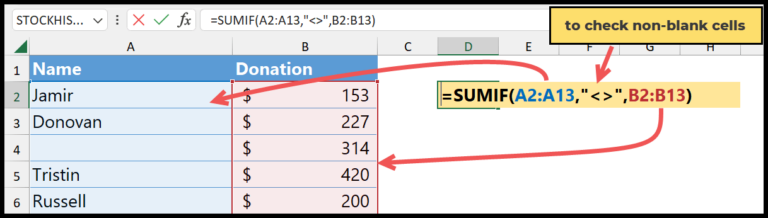

When selecting accounting software, one should ensure it integrates flawlessly with the Salesforce ecosystem. For example, QuickBooks, renowned for its powerful accounting features, offers an integration called the Salesforce Connector. This allows users to sync data such as invoices and sales receipts directly within Salesforce, promoting efficiency and reducing the chance of data entry errors.

Integrating with ERP Systems

Accounting software should also offer integration with ERP (Enterprise Resource Planning) systems for more complex operations. NetSuite is a notable ERP solution that provides comprehensive integration capabilities with Salesforce. This synchronization capability is vital for businesses looking to maintain coherence between their sales processes and back-end financial operations.

Multi-Platform Data Sharing

One cannot overlook the importance of multi-platform data sharing. The best accounting software permits the sharing of financial data across different software platforms, beyond Salesforce and ERP systems. This includes, but is not limited to, other CRMs, e-commerce tools, or bespoke databases. The aim is to achieve a state where data is synchronized in real-time or near-real-time to aid in decision-making and maintain data integrity throughout the organization.

Streamlining Sales and Accounting Processes

Integrating the sales and accounting processes is essential for businesses seeking improved efficiency and data accuracy.

Closing the Gap Between Sales and Accounting

To effectively close the gap, businesses are implementing native accounting software that interfaces with Salesforce. Accounting Seed is a prominent example, being built directly on the Salesforce platform. It automates tasks and minimizes manual data entry, which synchronizes sales data with financial records in real-time. This ensures that any update in the sales cycle reflects instantly in the accounting system, eliminating the lag time and potential for data mismatch.

Improving Collaboration and Productivity

The seamless integration between Salesforce and accounting software boosts collaboration. For instance, the sales team can access up-to-date financials to inform their sales strategies, while the accounting team has immediate visibility into sales transactions. QuickBooks Online, another software solution, is known for simplifying the financial aspect for small Salesforce businesses. Here’s a comparative look at the attributes of these software:

| Feature | Accounting Seed | QuickBooks Online |

|---|---|---|

| Designed For | General businesses | Small businesses |

| Integration with Salesforce | Native | Compatible |

| Task Automation | Extensive | Limited |

| Real-Time Data Sync | Yes | Yes |

| User-Friendly | Moderate | High |

The integration yields a marked increase in productivity as it reduces time spent on data entry and financial reconciliation, allowing teams to focus on their primary roles.

Financial Data Management and Analysis

Good sales force accounting software transforms numbers into strategic business insights. They’re adept at slicing and dicing financial data to deliver actionable reports.

Real-Time Insights into Business Performance

Real-time data is a game-changer. Sales force accounting platforms that offer live dashboards enable businesses to monitor their financial health as it happens. This means they can spot trends, catch issues early, and act swiftly. For instance, up-to-the-minute sales reports reveal the pulse of business activities, letting them adjust forecasts and resources accordingly.

Assessing and Maximizing Profitability

To keep their financial ship afloat, businesses need a solid grip on profitability. Good software helps them look beyond revenue by breaking down costs and cash flow. They can use financial reports to see which products are stars and which are duds. This kind of financials scrutiny steers them towards wiser investments and cost-saving tactics. The bottom line? It’s all about making more dough while spending less bread.

Addressing Business Needs with Custom Solutions

Finding the right accounting software for Salesforce can make a world of difference for a business’s operations. Companies, especially those utilizing Salesforce, require software that not only fits their business size but also adapts to their unique workflows.

Software for Different Business Sizes

Small businesses need accounting software that’s both affordable and user-friendly. Gusto, for instance, has been recognized as the best overall payroll software for small businesses in 2024, reflecting its suitability for smaller operations. QuickBooks Online, conversely, is often recommended for small Salesforce businesses for its compatibility and prevalence on “best of” lists.

Larger companies may require more robust options that offer extensive customization. Accounting Seed, built entirely on Salesforce, provides a comprehensive solution where accounting and CRM work seamlessly together, which can be particularly beneficial for larger entities like construction businesses that need full ERP systems.

Roles of Experts and Tailored Implementations

Experts play a crucial role in implementing the specific features that are necessary for a company’s accounting software. They can provide implementation services that ensure the software aligns well with a company’s particular needs. Customization, which can be critical for rapid changes in business processes, can often be accomplished with simple clicks and without the need for code through platforms like Accounting Seed.

Additionally, services such as flow builders or access to networks of API partners enable tailored implementations. These allow companies to extend their software functionality in ways that mirror their unique workflows and processes. This tailoring is particularly advantageous when businesses wish to consolidate their systems to save on costs and improve visibility from sales lead to general ledger.

Evaluating and Choosing Accounting Software

When hunting for the ideal Salesforce accounting software, one should not only look for how it impacts the bottom line but also how it aligns with financial management needs and scales with user growth. Here’s how to sift through the options.

Demoing and User Reviews

Demo: Getting hands-on with a demo allows a company to understand the software’s interface and features. For example, QuickBooks Online offers a comprehensive demo that can give a clear view of its integration capabilities with Salesforce and its effect on sales forecasts.

User Reviews: They are the unfiltered insights from those who’ve been in the trenches. A high number of positive reviews for Xero and FreshBooks often highlight the ease of use and customer support, which can significantly affect user satisfaction and, ultimately, revenue.

Cost-Benefit Analysis

Costs: They aren’t just about the license fee. Companies must calculate the total cost of ownership, which includes setup, customization, and training costs.

Benefits: This boils down to how well the software automates tasks and provides accurate financial data that can lead to better sales forecasting and financial management. Does the integration with Salesforce genuinely save time and improve the bottom line?

Long-Term Scalability

Scalability: The chosen software should grow as the company grows. It should also not just keep up but enable growth.

Software like Xero supports a business expansion with its multi-currency and various levels of service. Meanwhile, solutions like FreshBooks cater well to smaller businesses that aspire to scale up efficiently without switching platforms.

Additional Functionalities and Extensions

When it comes to managing finances in Salesforce, businesses have a plethora of tools at their disposal. Additional functionalities and extensions can significantly streamline accounting processes, making expense tracking, tax compliance, and reporting tasks more efficient.

AppExchange Accounting Applications

Salesforce’s AppExchange is like a treasure trove for users seeking specialized accounting applications. They can find a range of apps with native integrations that ensure a seamless flow of financial data within the Salesforce environment. Expense tracking becomes less of a chore with these applications, as they often feature intuitive dashboards and easy data input methodologies. For instance, apps like Accounting Seed cater specifically to Salesforce users, offering a full-fledged ERP system that’s highly rated by businesses with complex accounting needs.

Automation of Tax and Compliance

One cannot overstate the importance of tax and compliance automation in today’s business ecosystem. Extensions that automate VAT calculations and tax reporting save substantial time and minimize errors. They keep businesses aligned with local and international tax regulations. The integration of such applications within Salesforce not only simplifies the recording and filing of taxes but also ensures that all financial operations are compliant with the latest tax laws, thereby protecting businesses from costly penalties.

After Implementation: Managing and Optimizing Your Setup

After the implementation of Salesforce accounting software, the focus shifts to managing and optimizing the setup to ensure peak performance. The key is to maintain data integrity and a user-friendly experience while making the most of the available support structures.

Ensuring Consistency and Accuracy in Processes

Maintaining consistency and accuracy within the accounting processes is vital. With native Salesforce accounting software, users benefit from a single source of truth that’s integrated within the Salesforce ecosystem. They should conduct regular audits of data to identify and rectify any inconsistencies. Creating a routine for quality checks can involve:

- Regular Reconciliation: Scheduled reconciliation of accounts helps in maintaining accuracy across financial records.

- Validation Rules: Implementing rules that prevent data entry errors can greatly reduce inconsistencies.

Leveraging Customer Service for Ongoing Support

Effective customer service is integral for ongoing support post implementation. Users should be aware that native Salesforce accounting applications typically offer specialized customer service tailored to the nuances of their platform. They can use this support to:

- Resolve Issues: Immediate help for troubleshooting problems to minimize disruptions.

- Optimization Advice: Expert recommendations for system enhancements and updates for a user-friendly experience.

By actively engaging with customer service, users maintain the system’s efficiency and stay updated with the latest functionalities.

Frequently Asked Questions

Choosing the right accounting software for integration with Salesforce can greatly improve efficiency and streamline financial processes. This section aims to address common queries regarding such accounting solutions.

What’s a good accounting software that integrates well with Salesforce?

Accounting Seed and QuickBooks are frequently mentioned for their robust integration with Salesforce. They provide comprehensive accounting features, making them a good choice for businesses looking for a seamless experience.

Are there any free accounting tools that work seamlessly with Salesforce?

There aren’t many free accounting tools that offer complete integration with Salesforce. Small businesses may look for trials or basic packages from paid software which sometimes offer limited, but free functionalities.

Can you recommend accounting software suited for small businesses using Salesforce?

QuickBooks, especially when used with its Salesforce integration, is a popular option among small businesses. It’s known for its user-friendliness and scalability.

Is there a native accounting solution available within Salesforce itself?

Salesforce does not have a native general ledger solution. However, third-party applications like FinancialForce and Accounting Seed are built on the Salesforce platform, functioning closely with Salesforce systems.

How do Salesforce and QuickBooks compare for accounting purposes?

QuickBooks is a comprehensive accounting solution with a strong track record, while Salesforce primarily offers customer relationship management. However, the integration between QuickBooks and Salesforce provides a combination of powerful CRM and accounting tools.

Does Salesforce offer features similar to ERP for financial management?

Salesforce itself isn’t an ERP but it can be integrated with ERP solutions such as NetSuite. This integration can equip Salesforce with ERP-like features for holistic financial management.