In the ever-evolving world of e-commerce and online business, staying on top of sales tax can seem like a Herculean task for small business owners and accountants alike. They have to wrestle with various tax rates across different jurisdictions, and the rules are always changing. That’s where sales tax software steps in, providing a much-needed hand. This type of software not only helps businesses to calculate the right amount of tax, but it also makes the process of filing and remittance much more efficient and accurate.

Software solutions designed for sales tax management are tailored to ease the burden of tax compliance, allowing users to automate what can be a mundane and error-prone process. They can be particularly beneficial for small business owners who might not have a dedicated accounting team at their disposal. By using these tools, not only do businesses save valuable time, but they also mitigate the risk of costly errors associated with manual calculations and reporting.

Selecting the right sales tax software hinges on several factors including the size of the business, the complexity of the tax landscape it operates in, and the existing accounting infrastructure. Each software solution offers different features, pricing models, and integrations, ensuring that there’s a right fit for every business’s unique tax handling needs. Whether it’s cloud-based or web-based platforms, the goal remains the same: to streamline the sales tax process and give business owners peace of mind and more time to focus on growing their businesses.

Understanding Sales Tax

In tackling the complex world of sales taxes, businesses must grasp the basics, recognize state nuances, and differentiate between sales tax and VAT to ensure compliance and accurate calculations.

Basics of Sales Tax

Sales tax is a consumption tax imposed by government on the sale of goods and services. The seller collects it at the point of sale and remits it to the appropriate tax authority. In the United States, sales tax rates can vary widely by jurisdiction, which includes not only states but also counties and cities. The calculation of sales tax generally involves multiplying the tax rate by the sales price of the taxable good or service.

State Sales Tax Considerations

Each state in the U.S. sets its own sales tax laws, rates, and regulations. Businesses must adhere to the tax laws of the states where they operate. Furthermore, some states are known as origin-based sales tax states, where the tax rate is based on the location of the seller, while others are destination-based, taking into account the buyer’s location. This distinction is crucial when calculating and charging sales tax.

VAT vs. Sales Tax

While sales tax is only assessed at the final point of sale, Value-Added Tax (VAT) is collected at each stage of the supply chain where value is added. Unlike the sales tax, which is transparent to the consumer, VAT is embedded in the price and not as noticeable. Moreover, VAT is widely used outside the United States, including in European Union countries, which means companies engaged in international trade must manage VAT in addition to or in lieu of sales tax.

Choosing Sales Tax Software

When it comes to handling taxes, businesses need software that simplifies the complex. The right sales tax software keeps things accurate and compliant without sacrificing ease of use.

Key Features to Look For

User-Friendliness: They should look for a platform with a user-friendly interface that simplifies tax management, making it accessible to team members regardless of their tax knowledge.

Accuracy in Calculations: Accuracy is non-negotiable. Software solutions like TaxJar and Avalara are known for precise sales tax calculations that help businesses avoid costly errors.

- Automation: Automatic updates for tax rates and rules across different jurisdictions.

- Integration: Seamless connection with existing systems like QuickBooks Online.

- Reporting: Clear and detailed reports that make compliance and audits hassle-free.

Comparing Popular Solutions

| Software | User Reviews | Key Strengths | Best For |

|---|---|---|---|

| TaxJar | High | Comprehensive tax management | All-round tax compliance |

| Avalara | High | Advanced calculations, extensive integrations | Complex business needs |

| QuickBooks Online | Variable | Direct integration with accounting | Small to mid-sized businesses |

| Intuit ProSeries Tax | Positive | Desktop-based solution, quick and accurate filing | Professional tax preparers |

TaxJar shines for businesses seeking a robust, all-in-one tax solution. Avalara offers extensive integrations, making it ideal for businesses with more complex needs. Small to mid-sized companies might find QuickBooks Online‘s direct accounting integration invaluable. For tax professionals, Intuit ProSeries Tax provides quick and accurate tax filing with its desktop-based platform. Each solution offers unique merits depending on the business’s scale and requirements.

Sales Tax Compliance

Navigating the intricacies of sales tax compliance is crucial for businesses to avoid hefty penalties and ensure financial accuracy. Companies face a complex web of tax obligations and exemptions, and keeping up with regulations can be a formidable task. The right software simplifies these processes, providing assurance and efficiency.

Managing Tax Obligations

Companies must stay informed about the various tax obligations that come with doing business in different jurisdictions. Tracking and applying the correct tax rates becomes vital to avoid legal issues. Enterprises handle multiple types of taxes, including state and local sales taxes, which can vary widely by location. Handling tax exemption certificates properly is also key, as they must manage and validate these documents to comply with tax-exempt sales.

Compliance Automation

Compliance automation is a game-changer when it comes to sales tax. Modern software platforms offer tools that automate everything from identifying nexus, which is the connection between a business and a tax jurisdiction that establishes tax obligations, to creating detailed audit trails. This automation helps businesses stay on top of:

- Tax regulations: Staying updated with real-time changes in laws.

- Calculating taxes: Applying the correct rates on each transaction.

- Filing returns: Ensuring that returns are accurate and submitted on time.

By leveraging technology, companies minimize human error and free up resources, which can then be focused on core business activities.

Automating Tax Processes

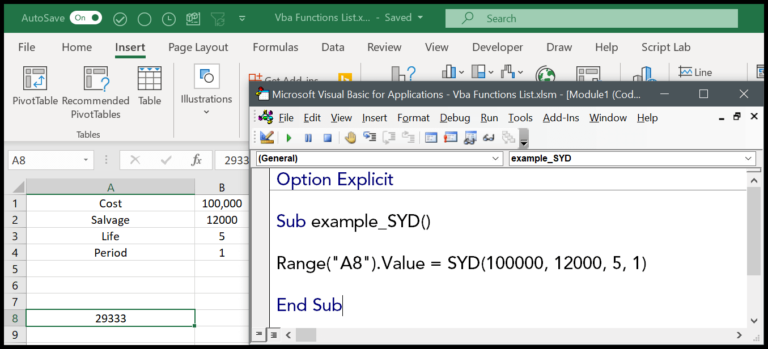

When it comes to sales tax compliance, automation software can simplify the complexity of tracking and applying the correct sales tax rates. This modern approach saves time and reduces the risk of human error.

Advantages of Automation

By automating tax processes, businesses enjoy several benefits. Automation makes handling large volumes of transactions manageable and increases accuracy. Here are key advantages:

- Reduced manual tasks: It minimizes the need for manual data entry and repetitive tasks.

- Increased efficiency: Businesses can process transactions faster and with fewer mistakes.

- Accuracy in tax calculations: Automated systems use up-to-date tax tables to ensure the correct amount of sales tax is applied and collected.

- Scalability: Automated tools can adjust to handle growth in transaction volumes without the need for additional staff.

Integration with Existing Platforms

Integration with a company’s existing platforms is vital to the successful implementation of tax automation. Seamless compatibility with various systems including ERP systems, POS, and accounting software like QuickBooks Online is important. Here’s how seamless integration enhances functionality:

- ERP Systems: Integrates tax solutions directly into enterprise resource planning systems, providing a centralized approach to tax management.

- POS Systems: Allows for accurate sales tax calculation at the point of sale, which is critical for retailers.

- QuickBooks Online: Syncs with popular accounting software to streamline financial workflows.

Effective integration ensures that tax automation not only simplifies the tax process but also strengthens the overall business workflow.

Efficient Tax Management

When it comes to sales tax management, businesses seek solutions that streamline the complexities of tax data handling and deliver insightful analytics for decision-making.

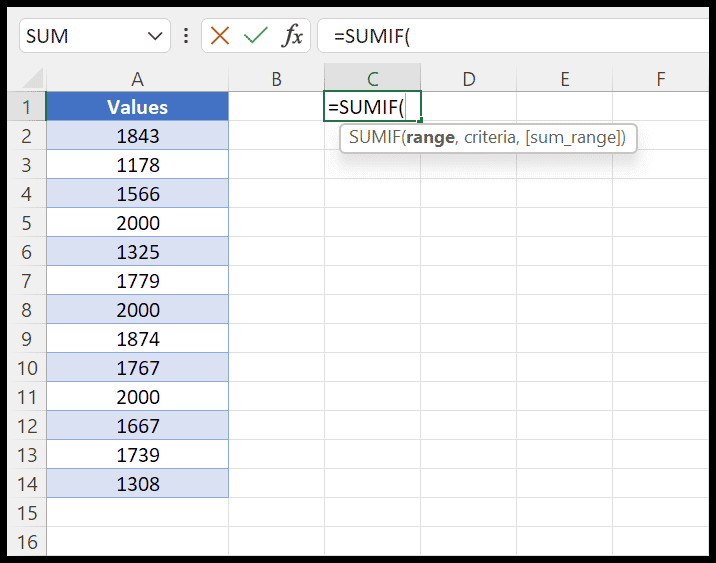

Handling Tax Data

Effective tax management software simplifies the process of dealing with tax data by automatically calculating rates and applying them to transactions. For instance, Avalara’s AvaTax boasts features that reduce manual entry, thereby lowering error rates. They manage the ever-changing tax landscape by providing timely updates pertinent to different jurisdictions.

- Tax Rate Calculation: Automation of accurate tax rate application for each transaction.

- Document Management: Centralization of all tax-related documents for easy access and review.

- Nexus Tracking: Tools to help businesses understand where they have a tax collection obligation.

Reporting and Analytics

The best sales tax software solutions offer detailed reporting and analytics, turning data into actionable insights. Pipedrive highlights efficiency by customizing the visual sales pipeline, which can enhance the average value of sales. A robust reporting module should feature:

- Detailed Reports: Breakdowns of sales tax collected and owed, sorted by jurisdiction.

- Analytical Tools: They transform raw tax data into strategic business insights.

Reporting Features:

| Feature | Description |

|---|---|

| Sales Tax Summary | Consolidates all sales tax data for a given period. |

| Filing Support | Generates pre-filled returns for easy tax filing. |

| Audit Trails | Detailed history logs to support potential audits. |

Such reports aim to provide clarity on financials and assist with tax compliance, potentially reducing the risk of audits and penalties.

Accuracy and Reliability

When it comes to sales tax software, nailing accuracy in tax calculations is non-negotiable. Companies lean on software to get tax rates right, because errors can lead to hefty fines and dreadful penalties.

Ensuring Accurate Calculations

The crux of sales tax software is its ability to accurately calculate the sales tax owed on each transaction. These platforms rely on up-to-date tax rate databases from various jurisdictions. Ensuring accurate calculations means less headache for businesses when it’s time to remit taxes. Software like Avalara’s AvaTax and TaxJar are known for their precision in tax calculation, hitting the mark for accuracy time and again.

- Tax Calculation: Real-time access to rates ensures the math is spot-on.

- Accuracy: Regular updates keep the software aligned with the latest tax laws.

Minimizing Penalties

No one likes to talk about penalties, but they’re a big deal. A simple miscalculation can lead to fines that no business would be thrilled to pay. Sales tax software strives to protect businesses from such mishaps by providing reliable tax rate data for every sale. TaxCloud, for instance, promotes its services as a way to shield users from the fallout of non-compliance by automating sales tax compliance processes.

- Penalties: Errors in tax calculations can trigger fines. Reliable software minimizes this risk.

- Fines: Staying on top of sales tax obligations means avoiding unnecessary financial burdens.

By choosing sales tax software that prioritizes accuracy and reliability, businesses can focus more on their growth and less on the looming dread of tax time errors.

Sales Tax Filing and Remittance

When it comes to sales tax, businesses need to ensure accurate collection, timely filing, and proper remittance of tax obligations. The technology involved in this process aims to minimize errors and maximize efficiency.

Streamlining Collection

Sales tax solutions aim to simplify the tax collection process. They integrate with various accounting and e-commerce platforms to automatically determine the correct sales tax rate for each transaction. For instance, TaxJar and Avalara, both renowned in the space, provide automate tax calculations during the checkout process, reducing manual effort and the risk of erroneous tax rates applied to purchases.

Effortless Remittance

Once taxes are collected, businesses must remit them to the appropriate tax authority. Top-tier software such as Avalara and TaxCloud simplifies this aspect by facilitating the remittance process. They not only help file sales tax returns but also manage refunds and other tax-related nuances. With fixed monthly rates—like TaxCloud’s $19.00 per month—the financial burden is predictable, and businesses can focus on their core operations without the hassle of manual tax processing.

Software for Different Businesses

Choosing the right sales tax software depends heavily on the size and nature of the business. Given the complexity of tax regulations, each business sector benefits from specific features tailored to its needs.

Solutions for Small Businesses

For small businesses, cost-effective and easy-to-use software can make a significant difference in managing sales taxes. They typically look for tools that offer straightforward functionality without the need for deep accounting knowledge. TaxCloud and Quaderno are notable for their affordability, with TaxCloud offering one of the industry’s lowest prices, and Quaderno starting at $49.00 per month. These platforms provide essential services such as tax rate determination, nexus tracking, and simple reporting, which are fundamental for small business accounting.

Tools for SaaS Companies

SaaS companies navigate a unique tax landscape where digital goods and services often have varying tax obligations across jurisdictions. Software like AvaTax ST by Avalara, with its cloud-based system and dedicated team of tax experts, can be particularly beneficial. They not only offer automated sales tax calculations but also provide assistance with compliance and remittance. Financial institutions, which may be involved in the financial operations of SaaS companies, also benefit from robust sales tax tools that can handle complex, multi-state regulations and automate filings.

Support and Customer Service

When selecting sales tax software, one should consider the kind of customer support and training resources available. Software with a strong support system can significantly enhance the user experience, especially for accountants who manage multiple tax files.

Quality of Customer Support

Good customer support is crucial for troubleshooting and streamlining the tax filing process. The best sales tax software tend to offer multiple channels of support, including phone, email, and chat systems. Responsiveness is also key, with top providers offering fast response times to inquiries. Some software options provide premium customer service, which may include dedicated support representatives and faster turnaround times for resolving issues.

Training Resources

Effective training ensures users can fully leverage the software’s capabilities. Leading software services usually feature a range of training resources, from video tutorials to detailed documentation.

- Video Tutorials: Visual learners appreciate walkthroughs of software features.

- Webinars: These offer opportunities to ask real-time questions and get clarifications.

- Documentation: Often available online, it provides in-depth details about the software.

Providing these educational resources, sales tax software can empower users, especially accountants who require in-depth knowledge to serve their clients effectively.

Pricing and Affordability

When talking about sales tax software, a user’s budget may be as varied as their needs. They’re looking for a solution that doesn’t break the bank but still delivers on value. The market offers diverse pricing strategies and the perks of trying before buying.

Subscription Models

Most sales tax software providers in 2024 operate on subscription-based models, which can greatly benefit businesses by spreading costs over time. Users typically choose from monthly or annual payments, with the latter often coming at a discounted rate. For instance, AvaTax ST, a popular cloud-based solution, may offer tiered pricing depending on the volume of transactions and complexity of tax compliance needs.

Free Trial Offers

A free trial is a common strategy used to entice potential customers, allowing them to test features without financial commitment. Software like hellotax often includes free trials, giving users a taste of the platform’s capability to manage VAT operations before they invest. Some providers might extend their free trials or offer basic versions of their software at no cost, which could be ideal for smaller businesses or those just starting out.

Additional Features

When scoping out the best sales tax software, savvy businesses look out for tools that not only calculate taxes but also offer features that cater directly to their unique needs. Key to these are customizable solutions for adapting to diverse business models and efficient management of tax exemptions.

Customizable Solutions

Many top-tier sales tax software options recognize that no two businesses are alike. They offer customizable solutions which allow companies to tailor the software to fit their specific workflows and tax handling requirements. For instance, ProSeries Tax by Intuit is noted for its adaptability, providing a variety of modules that can be configured to suit the size and complexity of a business’s operations. This flexibility ensures that businesses aren’t paying for features they don’t need.

- Customizable Integrations: Important for seamless workflow integration.

- User Permissions: Set different access levels for team members.

- Reports: Tailor reports to the information crucial for your business.

Another player that showcases a high degree of customization is Quaderno, which helps businesses by simplifying tax management with features explicitly aimed at ease-of-use and automation tailored to the businesses’ activities.

Exemption Management

No less critical is exemption management. This feature helps businesses identify and manage sales that are tax-exempt, ensuring compliance without overpaying. For example, Exemptax is designed to streamline the tax exemption process by validating and managing tax exemption certificates and ensuring the correct application of exemptions at checkout. They make the whole ordeal less of a headache by automating exemption certificate collection and renewal.

- Certificate Management: Automate collection and renewal of certificates.

- Accurate Application: Ensure exemptions are applied correctly at point of sale.

LOVAT also supports efficient exemption management, helping businesses handle international VAT compliance with provisions for dealing with various exemptions and reduced rates across different countries.

By implementing software with these additional features, businesses ensure they are equipped to handle the intricate details of sales tax compliance.

Cloud-Based Platforms

Cloud-based sales tax software solutions have revolutionized tax compliance by offering a range of real-time tax calculation and filing services. With the ease of integration and automated features, businesses find significant value in these platforms.

Benefits of Cloud Solutions

Cloud-based platforms provide users with scalability and flexibility to manage their sales tax obligations efficiently. For example, Vertex offers robust cloud-based software that supports real-time global sales tax calculations, which can be an invaluable tool for businesses with a broad customer base. Furthermore, platforms like TaxCloud present easily integrated solutions that cater to all US states and territories, streamlining the sales tax calculation process for online retailers.

Another notable cloud-based software, hellotax, simplifies VAT management for online retailers in Europe with its user-friendly interface. Platforms like DAVO use automated technology to set aside sales tax daily, securing funds for when filings are due, this convenience minimizes the hassle for businesses regarding tax payments.

Security Aspects

Security is a paramount concern when dealing with financial data. Cloud-based sales tax software typically invests heavily in securing client data. Stripe, for instance, is renowned not only for payment processing but also for its stringent security measures. Stripe’s infrastructure provides a high level of protection for transactions, which extends to its tax services.

Kashoo, a cloud-based accounting solution, also emphasizes security when handling sensitive financial information. These platforms are usually compliant with various security standards, such as PCI DSS and GDPR, which speaks to their level of commitment to data protection. Users can trust that their information is guarded against unauthorized access and breaches.

Frequently Asked Questions

When shopping for the best sales tax software, buyers often have a set of common questions they want answered. These questions range from the best choice for small businesses and online stores to what finance professionals recommend.

What’s the top tax software for small biz owners?

For small business owners, affordability and ease of use are key. They often lean towards FreshBooks for its simplicity and cost-effectiveness. FreshBooks not only assists with sales tax calculations but also offers a range of other accounting features suitable for small businesses.

Any standout sales tax programs for online stores?

AvaTax by Avalara stands out for online stores due to its cloud-based solution and robust integration with e-commerce platforms. It streamlines sales tax handling by automatically calculating the right tax for each transaction.

What do accountants swear by for handling sales tax?

Many professionals in the accounting field recommend Intuit TurboTax Deluxe for its comprehensive features and excellent support services. It provides thorough assistance for complex tax situations, which is a huge benefit for accountants dealing with diverse client portfolios.

Know any killer free sales tax tools out there?

Cash App Taxes offers a compelling free service, consolidating filing support without any hidden fees. This tool is especially valued by those looking for value without compromising on features.

Which tax compliance platforms do the big companies use?

Big companies often gravitate towards Capterra’s top-rated platforms like Xero, which can handle multi-currency transactions and provide customizable sales tax rates, making it ideal for larger business operations with more complex needs.

Is there a tax solution that totally nails automation?

AvaTax by Avalara is also notable for its automation capabilities, specifically designed to reduce the manual effort in sales tax compliance. It is known for its accuracy and ability to keep up with ever-changing tax laws.