In my experience with financial computations, especially when it comes to loans and investments, having a solid understanding of the tools at your disposal is crucial. That’s where Excel’s PMT function comes into play. It’s a powerful feature which does the heavy lifting by calculating periodic payments required to settle a loan or an investment. The beauty of this function, which also exists in VBA (Visual Basic for Applications), is its utility across different domains, be it for personal finance management or for business-related financial planning.

The PMT function considers a constant interest rate and payment period, simplifying the otherwise complicated task of figuring out your monthly financial commitments. Whether you’re penning down a VBA script in Excel or projecting financial outcomes in a business report, understanding how the PMT function works can immensely streamline the process of managing and predicting cash flows.

Syntax

Here’s how I frame my formula:

- Rate: my interest rate per period

- Nper: my total number of payment periods

- Pv: my principal value (loan or investment)

- Additional, optional parameters:

- [Fv]: my future value goal (default is 0)

- [Due]: my payment timing (start or end of period)

Arguments

In dealing with financial functions, especially when I’m calculating payments for a loan or an investment, I pay special attention to several key arguments:

- Rate: I use the interest rate per period. If my annual interest rate (APR) is 10 percent, and payments are monthly, my rate is 0.1/12.

- Nper: This is where I count the total number of payment periods. For an annual loan paid monthly, I’d have 12 payment periods per year.

- PV (Present Value): This tells me the principal amount of my loan or investment.

Additionally, there are a couple of optional arguments:

- [FV] (Future Value): I set this to what I expect to owe or own after the last payment. It’s set to 0 if I omit it.

- [Due]: Here’s where I indicate the timing of payments. ‘0’ means payments are due at the end of the period, and ‘1’ means they are due at the beginning. If I don’t specify, it defaults to ‘0’.

Example

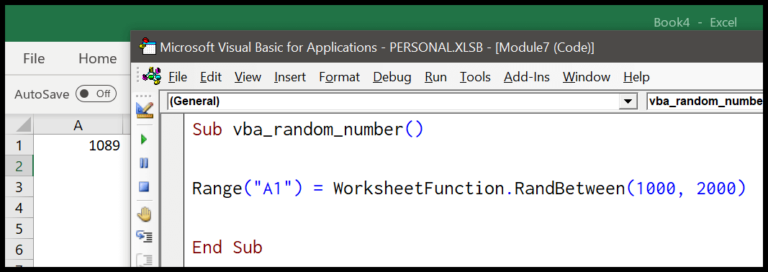

In one of my recent projects, I wrote some VBA code to figure out monthly payments. Here’s how I did it:

Sub example_PMT()

' Calculate monthly loan payment

Dim monthlyPayment As Currency

monthlyPayment = Pmt(0.08 / 12, 5 * 12, 98000)

' Display result in cell A9

Range("A9").Value = monthlyPayment

End Sub

All I did was use the PMT function to calculate the payment amount. I started by converting the annual interest rate to a monthly rate by dividing by 12. I also converted the loan duration to months by multiplying the years by 12. After running the code, I found that I needed to pay $1,987.09 each month.

Keep in mind, the actual output such as the 1987.09 I mentioned would appear in the designated cell in Excel, which in my example was cell A9. It’s quite a nifty way to quickly get the numbers you need for any financial planning or loan payments.

Notes

- In Excel, #NUM! pops up if I set nper (total periods) to zero in financial functions—it’s not a number game.

- For PMT, PPMT, IPMT, remember: PMT calculates periodic payment, PPMT addresses principal, IPMT targets interest.

- Keep track of units: mixing years and months messes up calculations—consistency equals clarity.

- Investments: entering a negative number for pv (present value) reflects cash outflow (e.g., initial deposit).

- Savings or annuity scenarios: a positive number shows regular deposits or equal cash flows coming in.

- Cash flows: Remember, money going out (payments, fees) is negative; money coming in (savings gains, dividend checks) is positive.

- Using Excel (2019/2016/2013), always format currency correctly for a clean money format—it keeps my cash balance on point.